It’s been less than a year since the Member States of the European Union had to cope with transposing the Fifth Anti-Money Laundering Directive (AMLD5) into their national legislation, meaning that many market actors, such as cryptocurrency exchange providers, faced the overwhelming challenge of complying with a complex set of rules. However, there is no time for compliance teams to sit back and rest, no sooner have they solved those tasks than the next puzzle is already writing around the corner: AMLD6. We’re here to give you the scoop on what to expect, but first, if you haven’t read our article about the previous Directives, click yourself over there to get caught up.

The governments’ endless fight against money laundering activities has a long history, which has had sometimes less, sometimes more success, but it can hardly be claimed that the job is done. Having realized that coherency between the various national legislations and cooperation between Member States in this area is far from being strong enough to win the war against the criminals, the EU have opened the next chapter, coming up with new rules to ensure a more effective fight. AMLD6 focuses on combating money laundering by means of criminal law. This is a very rare event, because harmonizing criminal law among the EU Member States has never been easy, and the EU has always been cautious in doing so because it affects fundamental rights and in many cases even the constitutions of the Member States, making it a very touchy subject. The many failed attempts to harmonize different areas of criminal law—such as this one, where the EU was planning to introduce minimum sanctions—makes this new piece of legislation a big success, and it shows that Member States do take money laundering very seriously.

The governments’ endless fight against money laundering activities has a long history, which has had sometimes less, sometimes more success, but it can hardly be claimed that the job is done. Having realized that coherency between the various national legislations and cooperation between Member States in this area is far from being strong enough to win the war against the criminals, the EU have opened the next chapter, coming up with new rules to ensure a more effective fight. AMLD6 focuses on combating money laundering by means of criminal law. This is a very rare event, because harmonizing criminal law among the EU Member States has never been easy, and the EU has always been cautious in doing so because it affects fundamental rights and in many cases even the constitutions of the Member States, making it a very touchy subject. The many failed attempts to harmonize different areas of criminal law—such as this one, where the EU was planning to introduce minimum sanctions—makes this new piece of legislation a big success, and it shows that Member States do take money laundering very seriously.

AMLD6 must be transposed into national law by the Member States by 3 December 2020, although the firms who fall under its scope will have a little more time to adapt to the new legislation: they have to be compliant by 3 June 2021. Let’s take a look at what the future of AML holds.

Reverse engineering money-laundering: the punishable predicate offences

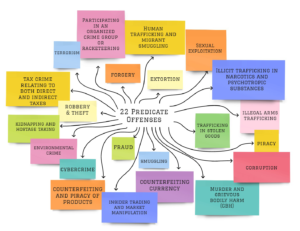

Expanding and specifying the list of predicate offences with regard to money laundering is, in our opinion, the most significant innovation of AMLD6. Before you start googling them, allow us to save you the trouble: in simple terms, a predicate offence is any crime that is a component of a more serious crime, or leads to such crime.

In money laundering, a predicate offence basically means the underlying criminal activity that generated the assets that were later laundered.

A simple example is drug trafficking: it leads to profits that can then be laundered. The basic idea of AMLD6 is to reverse engineer money laundering, break down the big crime into smaller crimes that are more easily identifiable, thus making it easier to hold accountable each person that adds something new to the chain that eventually adds up to money laundering.

The problem with the current, pre-AMLD6 situation is that the definition and list of these predicate offences are different in each country, therefore the criminalisation of money laundering is currently not coherent enough to ensure success in the battle against criminals. There are several weak points in the current, relevant, EU-wide law enforcement: insufficient uniformity of criminalisation leads to gaps in the criminal interpretation of the actual activities and their prosecution, and there are also legal obstacles to procedural cooperation between the competent authorities and ultimately crimes and their perpetrators might slip through these artificial voids. As a result, the list of 22 predicate offences (defined as ‘criminal activities’) AMLD6 lays down is the first important step in the right direction to consistency. The list includes terrorism, human trafficking and migrant smuggling, illegal arms dealing, counterfeiting of products, cybercrime, and even environmental crime. Thanks to AMLD6, these acts will be punishable as criminal offences throughout the EU when committed intentionally. In addition, while it is not an obligation, the Directive offers Member States the possibility of taking things one step further to criminalize and punish these offences even if they were not committed intentionally, but the offender is suspected or ought to have known that the property was derived from criminal activity.

The road to prison: Aiding and abetting, inciting and attempting are also punishable

In many countries, aiding and abetting, or inciting and attempting money laundering and related predicate offences are not currently punishable as criminal offences. AMLD6 puts an end to this, and such acts will now establish criminal liability. By including these ‘enablers’—those entities that help carry out money laundering and facilitate criminal activity—tracking money laundering could become easier.

Even companies can’t escape: criminal liability for legal entities and their representatives

AMLD6 extends criminal liability to legal entities, as well as natural persons holding a leading position within the entity (such as representatives, decision-makers, etc.) if they commit criminal offences for the benefit of the legal entity. This includes situations where the lack of supervision or control by these responsible persons was the very thing that made it possible for someone to commit the money laundering offence. This means that, under certain circumstances, neglecting to perform supervisory duties can lead to criminal prosecution. So, let’s say, you’re the CEO of a company and you decide to take your well-deserved two-week vacation on a peaceful island without looking at any emails. That in itself is not a problem, of course, even CEOs need a break—however, if meanwhile you let all your employees roam freely without leaving a deputy in charge, and someone in the company takes this opportunity to commit a few offences, then you’re likely to be in trouble.

Sanctions that can be imposed on legal entities according to AMLD6 may include exclusion from entitlement to public benefits or aid; temporary or permanent exclusion from access to public funding (including tender procedures, grants, and concessions); temporary or permanent disqualification from the practice of commercial activities; placing under judicial supervision; a judicial winding-up order; and temporary or permanent closure of establishments that have been used in committing the offence. In simple terms: your business may cease to exist as a result of an offence, or in the best case, suffer severe financial loss.

Sanctions that can be imposed on legal entities according to AMLD6 may include exclusion from entitlement to public benefits or aid; temporary or permanent exclusion from access to public funding (including tender procedures, grants, and concessions); temporary or permanent disqualification from the practice of commercial activities; placing under judicial supervision; a judicial winding-up order; and temporary or permanent closure of establishments that have been used in committing the offence. In simple terms: your business may cease to exist as a result of an offence, or in the best case, suffer severe financial loss.

In many Member States—for example the Netherlands—it is already possible to hold legal persons criminally liable, but this new harmonization certainly brings new challenges to countries like Sweden or Germany where, at this moment, this type of criminal conviction of companies is not possible, instead, their representatives who actually commit the crimes can be held criminally liable.

A less fashionable DIY: ‘self-laundering’

If the above expansions of the scope of the criminal offences and entities that can be held liable are not enough, AMLD6 takes it one step further by additional measures that will help the conviction of more money laundering-related crimes.

AMLD6 obliges Member States to ensure that criminal offences are also punishable as money laundering—in addition to the punishment of the predicate offence—when the perpetrator themselves has also committed the predicate offence. This means that this perpetrator will be prosecuted for not one, but two crimes. An example of this situation is when the smuggler who obtained certain funds from human trafficking is also the person who commits the transfer or concealment of these funds—thus, technically committing two money laundering offences. The term used for these crimes is called ‘self-laundering’, and the criminalisation of such cases regarding money laundering have not been harmonised in the Member States at all, until now. Thanks to AMLD6, all cases of self-laundering will be punishable as money laundering in all Member States.

AMLD6 obliges Member States to ensure that criminal offences are also punishable as money laundering—in addition to the punishment of the predicate offence—when the perpetrator themselves has also committed the predicate offence. This means that this perpetrator will be prosecuted for not one, but two crimes. An example of this situation is when the smuggler who obtained certain funds from human trafficking is also the person who commits the transfer or concealment of these funds—thus, technically committing two money laundering offences. The term used for these crimes is called ‘self-laundering’, and the criminalisation of such cases regarding money laundering have not been harmonised in the Member States at all, until now. Thanks to AMLD6, all cases of self-laundering will be punishable as money laundering in all Member States.

AMLD6, however, while strengthening the connection between money laundering and the underlying predicate offence as mentioned above, also loosens it in another sense. In order to ensure conviction in as many cases as possible, according to the new Directive it will not be necessary for there to be a criminal conviction for the predicate offence in order to secure a conviction for money laundering. What does this mean? It means that if John launders the money that came from drug trafficking, but it was Jane who committed the drug trafficking—which is the original crime, the predicate offence, it won’t be necessary for Jane to be convicted before John: John can go to jail for money laundering even if drug trafficker Jane is still walking and working freely. The new rules go even further: even identification of the perpetrator of the underlying predicate offence won’t be necessary. As long as there is enough evidence for conviction of the money laundering itself, criminal liability can be established regardless of the proceedings related to the predicate offence. So in the previous example, even if they have no idea that Jane was the drug trafficker, John may go to jail for money laundering.

Imprisonment for up to 4 years

![]() The main and most common type of criminal punishment for money laundering offences is imprisonment. This is not going to change, but the EU is now taking a stricter approach. AMLD6 requires Member States to impose a maximum term of imprisonment of at least four years in cases of money laundering offences, increased from the current one year maximum. Although many countries do already have a much higher maximum sentence than that imposed by the Directive, this means that after implementation, a natural person convicted of a money laundering offence can face up to four years in prison (or more), in any EU Member State. Of course, the questions remain: Which Member State can initiate criminal proceedings against a perpetrator? Who will conclude the trial? And which country will these criminals spend their prison years in? The answers to these questions all depend on the success and details of cross-border cooperation, which we talk about below.

The main and most common type of criminal punishment for money laundering offences is imprisonment. This is not going to change, but the EU is now taking a stricter approach. AMLD6 requires Member States to impose a maximum term of imprisonment of at least four years in cases of money laundering offences, increased from the current one year maximum. Although many countries do already have a much higher maximum sentence than that imposed by the Directive, this means that after implementation, a natural person convicted of a money laundering offence can face up to four years in prison (or more), in any EU Member State. Of course, the questions remain: Which Member State can initiate criminal proceedings against a perpetrator? Who will conclude the trial? And which country will these criminals spend their prison years in? The answers to these questions all depend on the success and details of cross-border cooperation, which we talk about below.

Organized criminal gangs and financial professionals are under the microscope

There are two instances that it will be compulsory for Members States’ to consider as aggravating circumstances in their harmonized criminal legislation. When something is considered to be an ‘aggravated circumstance’ in relation to a criminal offence, it means that the penalty imposed on the person who committed the crime under such circumstances will be higher than it would otherwise have been had those circumstances not been present. One of these circumstances in AMLD6 is committing the money laundering offence as part of an organised criminal gang. The other is when the offender is an obliged entity according to AMLD5—meaning they fall under extended scope of the anti-money laundering regulations currently in place—and have committed the offence in the exercise of their professional activities. The latter includes, for example, if a compliance officer at a bank commits the money laundering offence, in the course of his/her activities carried out while working for the bank.

Increased cross-border cooperation in law enforcement

![]() One huge problem that always needs to be mentioned when talking about money laundering is insufficient international cooperation between the competent authorities or the complete lack of it. Especially when trying to tackle something as global as money laundering and the financing of terrorism, the ability of different countries to collaborate and support each other is crucial. However, without harmonisation, due to the differences in the legal procedures and allocation of responsibilities, and sometimes—let’s face it—with the additional language barrier, such cooperation is never easy. This is what AMLD6 intends to improve, and potentially put an end to these barriers of cooperation and law enforcement alliances—at least the legal ones.

One huge problem that always needs to be mentioned when talking about money laundering is insufficient international cooperation between the competent authorities or the complete lack of it. Especially when trying to tackle something as global as money laundering and the financing of terrorism, the ability of different countries to collaborate and support each other is crucial. However, without harmonisation, due to the differences in the legal procedures and allocation of responsibilities, and sometimes—let’s face it—with the additional language barrier, such cooperation is never easy. This is what AMLD6 intends to improve, and potentially put an end to these barriers of cooperation and law enforcement alliances—at least the legal ones.

First of all, the Directive clearly states the situations in which a Member State needs to establish its jurisdiction: in cases where the money laundering offence is committed in the territory of the Member State, or the offender is a national of that Member State. This means that in such cases, a Member State has to ‘own’ and conclude the criminal procedure and cannot claim lack of jurisdiction.

Truth be told, it usually works the other way around: instead of having no country to prosecute, we have more than one standing in line. Especially in case of global crimes like money laundering and terrorism financing, in most cases there’s no way to pick just one country, or to take it one step further, even the geographic territory where the crime was committed. It most likely took place in multiple countries, over the internet, involving people of different nationalities, computer servers in lots of different countries, the list goes on. Not to mention those fortunate ones with multiple citizenship: they are already considered as nationals of two or more different countries. It’s only natural that when so many Member States are involved, they all want to convict the people responsible, which can cause chaos if the procedures are not coordinated. With the new measures of AMLD6, in cases where more than one Member State has jurisdiction and can validly prosecute, these Member States will be obligated to cooperate and decide on who should be the one prosecuting the offender. The goal is to centralise and have each step of the criminal proceedings carried out in the same, individual Member State. However, the Directive itself is worded so briefly, we don’t yet know anything about how this cooperation and centralisation should be imagined in practice, what criteria Member States will decide on the country leading the procedure and how the other Member States will be able to play a role in the proceedings. We’ll need to wait and see what the Member States come up with when implementing the new rules into their national laws.

AMLD6 introduces further measures for more efficient and swift cross-border cooperation and communication between competent authorities, and it also includes an article that sets out requirements for Member States to have “effective investigative tools”. The latter meaning the latest and most effective tools available, such as those used in combating organised crime and other serious crimes, to ensure the success of investigations related to money laundering.

The future of anti-money laundering

While, as stated before, Member States have until December to implement the new rules, it is consequently still very early to predict anything about its fallout, there are already a few reasons to be a little sceptical about the overall future success of AMLD6.

One is the fact that Denmark is not taking place in this harmonization. This is, however, probably less of an issue, as Denmark already has most of the provisions of the Directive in their national laws: most of the predicate offences, as well as self-laundering are considered criminal offences and criminal conviction and liability of legal entities is already possible. The main question here is the cross-border cooperation, which brings us to the next concern: there is already supposed to be an advanced cooperation between FIUs in the EU to help fight money laundering, and as described in one of our previous articles. While it looks good on paper, even this type of cooperation has its problems in practice. Imagine how this would be different in case of criminal procedures, which are, by their nature, even more sensitive—our concern is that it won’t be, and this harmonised cooperation is probably doomed to fail. Still, let’s hope for the best!

Regarding the future of AML/CTF, the European Commission is not resting on its laurels: in May of 2020, they published a new Action Plan on the matter. The Action Plan contains proposed actions for the future, such as supporting the Member States in implementing the necessary reforms, evaluating and assessing the possibility, functions and scope of an EU level AML/CTF supervisor (the purpose of which would assure strong harmonization, compliance and cooperation) or assess how a single rulebook in the field of AML and CTF would be best delivered, including by turning AMLD5 into a Regulation. Given the frequency of AML/CTF related regulations change nowadays, we have reason to suspect that, based on the Action Plan, 2021 will bring about some new Directives, or even a Regulation.

Anyhow, one thing seems to be sure. In today’s uncertain times with corona and all further global crises of unemployment and economic breakdown, the position of compliance officer appears to offer a very sound income and solid market demand for any of you who are thinking about a career change.